How Credit and Financing Empower Auction Participants Let’s be honest — auctions are intense. Whether you’re trying to grab a rare collector’s item or bidding on a truck for your business, everything moves fast. You either act or miss out. That rush is part of the thrill, but it also makes one thing really clear: you need to have your […]

Big Loans, Smart Moves: How to Get Ready for Major Borrowing

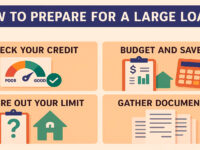

How to Prepare for a Large Loan Taking out a large loan can be exciting, but it’s also serious business. Whether you’re buying a home, launching a startup, or investing in a personal milestone, borrowing a big sum means taking on a big responsibility. The more prepared you are, the smoother it will go — and the better the terms […]

How to Stay Financially Smart When Borrowing Becomes Invisible

What to Do If Loans Become “Invisible” (Embedded in Services) You used to know when you were borrowing money. There was a contract, a credit check, a repayment plan. Now, things aren’t so clear. You pay for a phone in monthly “installments” without calling it debt. You split your rent into smaller weekly payments. You get your groceries and settle […]

Invest or Pay Off Debt First? Here’s How to Decide Like a Pro

What Is More Profitable: To Repay a Loan or to Invest? You’ve got some extra money. It’s sitting in your account, waiting for a decision. Should you use it to chip away at that lingering loan? Or throw it into the market and hope it grows? It’s a common dilemma — and one that doesn’t have a one-size-fits-all answer. On […]

How to Turn Mortgage Interest into Tax Savings

Is It Possible to Refund Personal Income Tax on Mortgage Interest? If you’re paying off a mortgage, you already know how heavy those monthly payments can feel. It’s a long game — often stretching across decades. But what if some of that financial pressure could be eased by the tax system? A lot of people don’t realize this, but in […]

Loan Payments and New Jobs: Avoid These Costly Mistakes

Financial Risks When Changing Jobs and Having a Loan Switching jobs can feel like hitting the refresh button on your career. New people, better pay, more growth — or at least, that’s the hope. But if you’ve got an active loan, that move can get complicated fast. Most of us don’t think about our debts when signing an offer letter. […]