How Credit and Financing Empower Auction Participants Let’s be honest — auctions are intense. Whether you’re trying to grab a rare collector’s item or bidding on a truck for your business, everything moves fast. You either act or miss out. That rush is part of the thrill, but it also makes one thing really clear: you need to have your […]

How Culture Shapes Credit: Global Lending Through a Local Lens

The Role of Cultural Factors in Regional Lending Practices Why do some people take out loans with ease while others avoid borrowing altogether? The answer isn’t just about income or laws — it’s also about culture. Around the world, borrowing isn’t viewed the same way. Some cultures see credit as a useful tool. Others associate debt with shame, risk, or […]

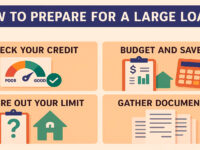

Big Loans, Smart Moves: How to Get Ready for Major Borrowing

How to Prepare for a Large Loan Taking out a large loan can be exciting, but it’s also serious business. Whether you’re buying a home, launching a startup, or investing in a personal milestone, borrowing a big sum means taking on a big responsibility. The more prepared you are, the smoother it will go — and the better the terms […]

How to Stay Financially Smart When Borrowing Becomes Invisible

What to Do If Loans Become “Invisible” (Embedded in Services) You used to know when you were borrowing money. There was a contract, a credit check, a repayment plan. Now, things aren’t so clear. You pay for a phone in monthly “installments” without calling it debt. You split your rent into smaller weekly payments. You get your groceries and settle […]

Why We Borrow for Things We Can’t Afford — and Don’t Need

Why People Take Out Loans Unnecessarily We’ve all seen it happen. A friend takes out a loan for a new phone when the old one works just fine. Someone borrows to fund a vacation, a wedding, or the latest gadget. It’s easy to assume they’re being reckless. But the truth is more complicated. In today’s world, unnecessary borrowing isn’t always […]

Loan Payments and New Jobs: Avoid These Costly Mistakes

Financial Risks When Changing Jobs and Having a Loan Switching jobs can feel like hitting the refresh button on your career. New people, better pay, more growth — or at least, that’s the hope. But if you’ve got an active loan, that move can get complicated fast. Most of us don’t think about our debts when signing an offer letter. […]