How to Declare Bankruptcy of an Individual

Let’s be honest — when debt gets out of control, the word “bankruptcy” can feel like a punch to the gut. It sounds final, scary, and maybe even shameful. But for many people, it’s not a defeat. It’s a second chance. It’s a reset when everything else has failed. If your bills are piling up, collectors are calling nonstop, and you’re losing sleep trying to figure out how to stay afloat — it might be time to learn how bankruptcy really works.

This guide walks you through the personal bankruptcy process step by step. No complex terms, no legal speak, just clear and simple information about what it means, how to file, and what life looks like after it’s done. It’s not a magic wand, but it can give you space to breathe, regroup, and rebuild.

What Declaring Bankruptcy Actually Means

Declaring bankruptcy means telling the government you can’t pay your debts. Once you file, the courts and legal system step in to help figure out what happens next. You either get some or all of your debts forgiven, or you get set up with a structured plan to repay them over time. Either way, the process gives you legal protection — creditors can’t sue you, garnish your wages, or keep sending collection notices while the case is active.

There are usually two kinds of bankruptcy for individuals. One is liquidation — where some of your assets might be sold to pay debts, and the rest is wiped clean. The other is a structured repayment — you keep your property but agree to pay a portion of what you owe over a set period. Your income, assets, and the kind of debt you have will determine which route you can take.

When Is Bankruptcy the Right Option?

Bankruptcy is serious. It’s not a quick fix, and it comes with consequences. But it’s also a valid legal option for people who’ve hit the end of the road. If you’ve already tried cutting back, working extra jobs, negotiating with creditors, or doing debt consolidation, and nothing has worked — this might be your path forward.

Some signs you might want to consider bankruptcy include:

- You’re only making minimum payments and still falling behind

- You’re using one form of debt to pay off another

- You’ve had wages garnished or lawsuits filed over debt

- You owe more than you could realistically pay back in several years

- You’ve exhausted other plans like refinancing or repayment programs

If you feel like you’re drowning in debt with no way out, filing might be the most responsible step you can take to protect your mental health, your stability, and your future.

Getting Started: What You’ll Need

The first step is to take a good, honest look at your finances. Gather up everything: bills, pay stubs, bank statements, tax returns, loan documents, and even things like insurance or investment info. You’ll need to list your income, your expenses, your assets, and your debts in full detail.

From there, most people consult a bankruptcy attorney or financial counselor. Some offer free sessions to walk you through your options. They’ll help you figure out what kind of bankruptcy (if any) you qualify for, what’s protected, and what might be at risk. You can file without a lawyer, but be prepared for a lot of paperwork and deadlines. Missing something small could delay or even cancel your case.

Once your paperwork is filed with the court, you get what’s called an “automatic stay.” This means all debt collection must stop immediately — no more calls, no more wage garnishments, no new lawsuits. It gives you space to sort things out.

The Bankruptcy Process Step-by-Step

Here’s what typically happens after you file:

- You attend a credit counseling session. This is mandatory and usually lasts about an hour. It can be done online or by phone. It’s meant to help you understand what bankruptcy is and whether you really need it.

- You file your bankruptcy petition. This includes all your financial info — income, debt, expenses, assets. You’ll also need to list things like recent big purchases or transfers of property.

- A trustee is assigned to your case. This person works on behalf of the court to review your documents, verify your information, and look for anything unusual.

- You attend a creditor meeting. This is usually short and simple. The trustee asks you questions, and creditors can too (though most don’t show up). It’s not a trial — just a check-in.

- Your case is either discharged or dismissed. If everything checks out, your debts are either wiped out or restructured, depending on the type of bankruptcy. If your paperwork is incomplete or you don’t follow the rules, the court can dismiss your case.

What Happens to Your Home, Car, and Other Stuff?

This is the part that makes most people nervous. Will I lose everything? The short answer: probably not. Bankruptcy laws usually let you keep the basics — your home, your car (if it’s not overly valuable), your clothes, your tools if you need them for work, and sometimes even your retirement savings.

The court looks at what you own and what it’s worth. Things considered “exempt” can’t be touched. If you own expensive property beyond those exemptions — like a second home, valuable collectibles, or a luxury car — you might have to sell or give those up. But the goal isn’t to leave you with nothing. It’s to help you get back on track with a clean slate.

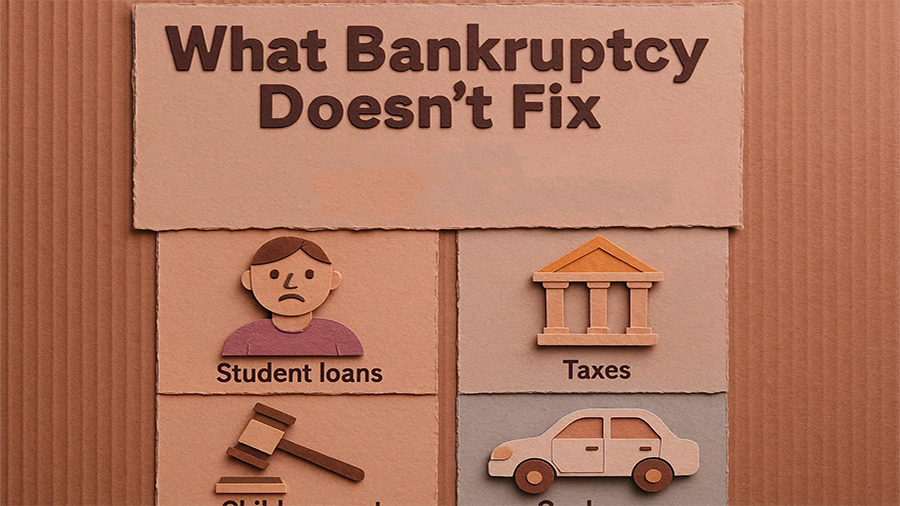

What Bankruptcy Doesn’t Fix

While bankruptcy can wipe out a lot of unsecured debts — credit cards, medical bills, payday loans — it doesn’t erase everything. Here are some things that usually stay:

- Student loans (except in rare hardship cases)

- Child support and alimony

- Recent tax debts

- Court fines or criminal restitution

- Debts from fraud or intentional wrongdoing

Make sure you understand what bankruptcy will — and won’t — take care of, so you’re not surprised down the line.

What Life Looks Like After Bankruptcy

There’s a recovery period, no doubt. Your credit score will drop. Getting new credit, renting an apartment, or getting a loan may be harder for a while. But it’s not permanent. Most bankruptcies stay on your credit report for 7 to 10 years, but your score can begin to improve within months.

In fact, for many people, filing is the first step toward better financial health. You’re no longer trapped under growing interest or collection threats. You can build a budget, rebuild your savings, and take your time to repair your credit. A lot of people get approved for new credit cards, car loans, or even mortgages just a few years after filing — as long as they show good habits going forward.

The Conclusion

Declaring bankruptcy doesn’t mean you failed — it means you’re taking control. It’s not easy, and it’s not free from consequences. But it’s often the smartest, most honest choice a person can make when they’ve run out of options. If debt is hurting your health, your relationships, or your peace of mind, don’t wait. Get the facts. Talk to someone. And remember, bankruptcy isn’t an end. It’s a beginning — and you deserve a fresh start.