How to Prepare for a Large Loan

Taking out a large loan can be exciting, but it’s also serious business. Whether you’re buying a home, launching a startup, or investing in a personal milestone, borrowing a big sum means taking on a big responsibility. The more prepared you are, the smoother it will go — and the better the terms you’re likely to get. This guide will walk you through what to do before you even talk to a lender, all in plain, relatable language.

Why Preparation Is Everything

Lenders don’t hand over large loans without digging into your financial life. They want to be sure you’re not only able to pay the money back but that you’ll do it on time for years to come. So they look at your credit, your income, your current debt, and even how steady your job is. The more confident they feel, the better your chances of approval — and of landing a deal that doesn’t cost you more than it should.

The long-term impact

A big loan means long-term payments. You’ll be committing to monthly obligations that may last five, ten, or even thirty years. You want to know ahead of time that your budget — and your life — can handle it. And if it turns out you’re not quite ready? That’s not a failure. That’s useful information. You can hit pause and fix a few things first.

Know What Lenders Care About

Credit score: your financial track record

Your credit score is often the first thing lenders look at. It tells them how well you’ve handled borrowing in the past. A higher score means better odds of approval and lower interest rates. If your score is low, you’re not doomed — but you may have to accept stricter terms or delay your application until you’ve improved it.

Income and stability

They’ll want to see that you make enough money to cover this new loan, along with your existing expenses. That doesn’t just mean a high salary — it means consistency. If you’ve had the same job for a while or work in a stable industry, that helps your case.

Debt-to-income ratio

This number compares what you owe each month to what you earn. If too much of your income is already going to other debts, lenders get nervous. Ideally, you want your total monthly debt to be less than 35–40% of your income.

Savings cushion

Even though you’re borrowing, having savings matters. It shows you’re financially responsible and can handle emergencies without missing payments. Some lenders may even ask to see proof of a few months’ worth of living expenses saved up.

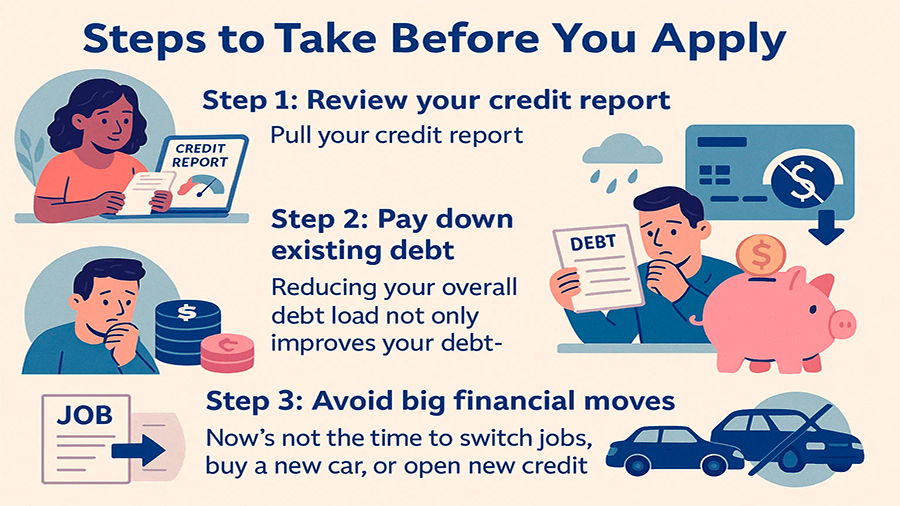

Steps to Take Before You Apply

Step 1: Review your credit report

Pull your credit report from all three major bureaus. Check for any mistakes and dispute them. If your credit utilization is high — meaning your credit cards are near their limits — try to pay those down. It’s one of the quickest ways to boost your score.

Step 2: Pay down existing debt

If you’re carrying balances on multiple loans or credit cards, it’s time to shrink them. Reducing your overall debt load not only improves your debt-to-income ratio but also makes you look like a more responsible borrower.

Step 3: Build your savings

Even if you’re focused on paying down debt, put something aside in savings. A small emergency fund of 2–3 months’ expenses goes a long way in showing lenders you’re prepared. It also gives you peace of mind when unexpected expenses pop up.

Step 4: Avoid big financial moves

Now’s not the time to switch jobs, buy a new car, or open new credit accounts. Lenders want to see stability. Big changes in your financial profile can delay or complicate the approval process. Keep everything steady while you’re prepping for the loan.

Get Your Documents in Order

What to gather

Documentation makes or breaks your application. You’ll likely need pay stubs, tax returns, bank statements, ID, and possibly proof of assets or liabilities. If you’re self-employed, expect to provide extra paperwork — like profit and loss statements or business records.

Why it matters

Having these documents ready makes the process smoother and faster. It also signals that you’re organized and serious. No one likes chasing down paperwork at the last minute — especially not lenders.

Choosing the Right Lender

Not all lenders are alike

Some offer quick approvals, others have lower rates. Some are better for mortgages, others for business loans. Take time to compare offers. Don’t just look at interest rates — check fees, repayment terms, and customer service too. Get quotes from at least three lenders before you commit.

Questions to ask

Ask about total repayment costs, how flexible the terms are, and what happens if you want to pay off early. Read everything, especially the fine print. A slightly better rate can come with hidden fees that cost more in the long run.

When You Know You’re Ready

Check your gut

Financial prep is important, but so is your comfort level. Does the monthly payment fit into your budget without stress? Do you have a backup plan if your income drops for a while? Are you confident you understand the loan terms?

Don’t rush the process

If the answer to any of those questions is no, it’s okay to wait. You’re better off delaying a few months than jumping in too soon and regretting it. Preparing now gives you options later — and peace of mind all the way through.

The Bottom Line

Preparing for a big loan isn’t glamorous, but it pays off. When you walk into a lender’s office with strong credit, low debt, some savings, and your paperwork in order, you send a message: “I’ve got this.” And that confidence shows in the rates you’re offered, the terms you can negotiate, and the ease of the process.

So take the time to do it right. It’s your money, your loan, your future — and with the right prep, it’s also your decision to make with clarity, not stress.