The Role of Cultural Factors in Regional Lending Practices

Why do some people take out loans with ease while others avoid borrowing altogether? The answer isn’t just about income or laws — it’s also about culture. Around the world, borrowing isn’t viewed the same way. Some cultures see credit as a useful tool. Others associate debt with shame, risk, or failure. These beliefs directly affect how people interact with lenders, and in turn, how lenders design and offer financial products.

If we want to understand global lending patterns, we have to look beyond spreadsheets. We have to talk about values, norms, and trust. In this article, we explore how different cultural attitudes shape regional lending behavior, how lenders respond, and why context matters more than ever in the age of digital finance.

Different Places, Different Views on Debt

Debt is not neutral. For some, it’s a stepping stone. For others, it’s a sign of failure. In countries like the United States or Canada, credit is normalized. It’s common to take out student loans, mortgages, or use credit cards for everyday purchases. Good credit behavior is even seen as a sign of responsibility.

But in countries like Germany or Japan, many people are more cautious. Borrowing is often associated with risk or dependency. There’s a stronger cultural preference for saving and avoiding debt unless absolutely necessary. Even young people grow up with the idea that paying in cash is better than owing someone money.

Trust in Lenders Also Varies

It’s not just about how borrowers feel about debt — it’s also about how much they trust the institutions offering it. In high-trust societies, people are more likely to work with banks or digital lenders. In lower-trust regions, borrowers may prefer informal credit networks like family, neighbors, or local cooperatives. That preference shapes both behavior and business models.

Cultural Lending Habits by Region

The table below shows how cultural norms shape borrowing in different parts of the world. These aren’t hard rules, but they give a broad picture of how habits vary based on local values.

| Region | Attitude Toward Debt | Common Lending Channels |

|---|---|---|

| North America | Debt seen as useful and normal | Banks, credit cards, digital lenders |

| East Asia | Debt linked to shame or loss of face | Family loans, traditional banks |

| South Asia | Mixed attitudes; often need-based | Microfinance, informal lending, co-ops |

| Latin America | Debt often used for family needs | Retail credit, local lenders, peer lending |

| Western Europe | Debt accepted but used carefully | Regulated banks, public credit systems |

| Sub-Saharan Africa | Debt common in informal networks | Mobile money, village groups, SACCOs |

Each region has its own rhythm. In Sub-Saharan Africa, for example, mobile money platforms have transformed access to credit by meeting people where they are — often far from physical bank branches. Meanwhile, in East Asia, lenders know to offer products discreetly to avoid embarrassing borrowers.

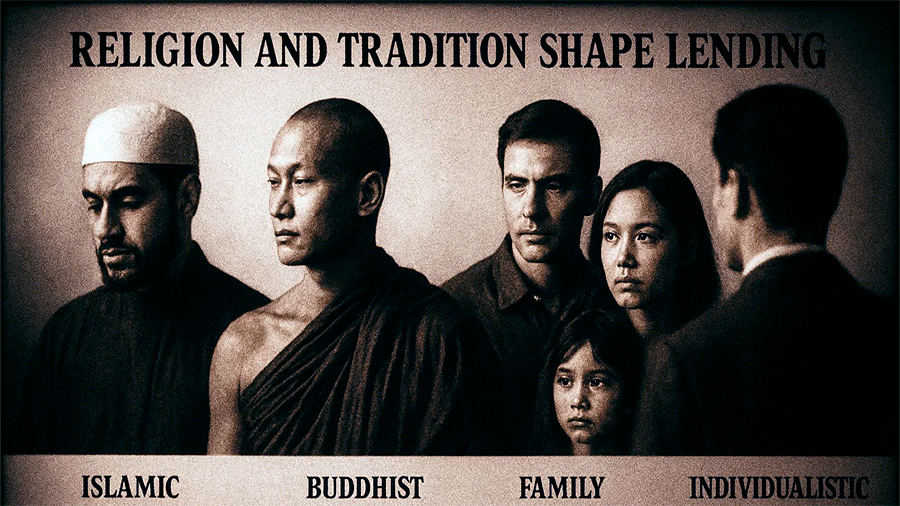

Religion and Tradition Shape Lending

Religion plays a major role in how credit is viewed and delivered. In Islamic countries, charging interest is forbidden (haram), so Islamic finance operates on profit-sharing or fee-based models instead. This system still offers loans, but structured to align with faith. That means lenders must design products differently depending on the region’s dominant beliefs.

In some Buddhist communities, borrowing is seen as a sign of attachment to material goods, which is discouraged. That doesn’t mean people don’t borrow, but it does mean there might be more social caution or preference for avoiding high-risk loans.

Even beyond religion, traditional values influence behavior. In family-oriented cultures, borrowing to support a relative or for group benefit is more acceptable than borrowing for personal gain. In contrast, highly individualistic cultures may focus more on credit scores and personal responsibility.

How Lenders Adapt to Culture

Lenders aren’t blind to these differences. In fact, successful lenders often tailor their approach depending on the region. Below is a snapshot of how loan providers adjust practices to reflect local expectations.

| Region | Adapted Lending Practice | Why It Matters |

|---|---|---|

| Japan | Private communication with borrowers | To avoid public embarrassment |

| India | Weekly microloan repayment schedules | Fits cash flow of informal workers |

| United States | Credit-based product promotions | To encourage regular spending behavior |

| Nigeria | Mobile group credit systems | Leverages social trust and accountability |

Designing loans isn’t just about pricing or approvals. It’s also about tone, timing, and trust. A one-size-fits-all model often doesn’t work, especially in communities where culture plays a big role in financial decision-making.

Technology Doesn’t Always Bridge the Gap

Fintech has changed how credit is offered, but it hasn’t erased cultural differences. Apps and algorithms created in one country don’t always work well in others. For example, a credit scoring system based on bank history may not apply in places where most people don’t use banks. That’s why smart lenders now combine traditional data with local insights — such as payment behavior in informal networks or reputation within a village group.

Some global lenders are starting to use hybrid models. Others are building region-specific platforms with local partners who understand community habits. What’s clear is that ignoring culture doesn’t just lead to missed profits. It leads to distrust, high default rates, and products that simply don’t fit.

The Conclusion

Culture isn’t a side detail in lending. It’s central. It shapes who borrows, how they repay, and whether they feel respected by the system. The best lenders don’t just offer credit. They learn how people feel about it, who they trust, and what financial behavior looks like in everyday life.

As credit goes digital and global, understanding these cultural layers is more important than ever. Because behind every loan is a person — and behind every borrower is a set of values you can’t afford to ignore.