How Credit and Financing Empower Auction Participants

Let’s be honest — auctions are intense. Whether you’re trying to grab a rare collector’s item or bidding on a truck for your business, everything moves fast. You either act or miss out. That rush is part of the thrill, but it also makes one thing really clear: you need to have your money lined up before you raise that paddle or click that button. And for most people, that’s where credit and financing step in.

These days, not everyone walks into an auction with a pile of cash. In fact, more and more bidders — from individuals to small business owners — are using financing to make it possible to bid at all. But how does that actually work? And is it smart? Let’s talk about how credit helps in auctions, when it makes sense, and what to look out for so you don’t end up regretting your big win.

Why Financing Matters at Auctions

The main reason financing is useful is simple: auctions don’t wait. If you win a bid, the payment usually needs to be made quickly — sometimes on the same day, or within a couple of days. That’s not a lot of time to sort things out, especially if you’re bidding on something big like property or equipment.

With financing, you don’t need to have the full amount on hand. You use a loan or credit line to cover the purchase, and then pay it back over time. It takes the pressure off your cash flow and gives you the flexibility to go after what you want without stressing over your bank balance. In a fast environment like an auction, that can make all the difference.

Get Ready Before You Bid

If you plan to use financing, don’t wait until after you’ve won the item to figure it out. Most auction houses won’t give you a grace period to run to the bank. You’ll want to talk to a lender ahead of time and get pre-approved. That way, you know your limit, and you can bid with some peace of mind. It also helps you avoid making snap decisions you’ll regret later.

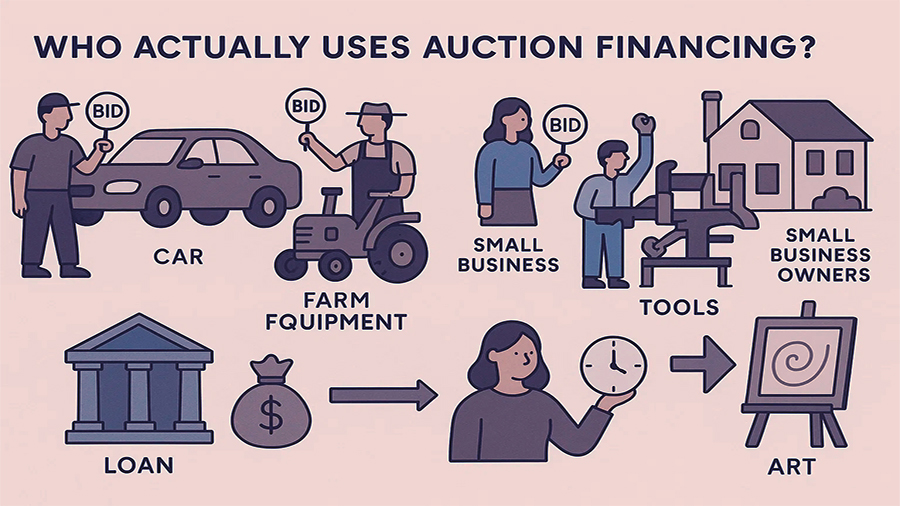

Who Actually Uses Auction Financing?

You might think auction financing is just for big companies or seasoned investors, but that’s not true. It’s surprisingly common — especially for buyers who are looking at high-ticket items. People use it for buying cars, farm equipment, property, furniture, even art. Small businesses use it all the time to pick up tools or machines without tying up their working capital.

Sometimes it’s just about timing. Maybe you’ll have the money next month, but not today — and the auction is happening now. A loan helps bridge that gap. Or maybe you’d rather keep your savings for emergencies and pay the loan off gradually instead. That’s a personal choice, and when the numbers make sense, it can work really well.

Borrowing Can Level the Field — If You’re Prepared

One big advantage of financing is that it lets regular buyers compete with those who have more money on hand. It makes auctions a bit more accessible. But it’s not a magic trick. You still need to have a plan, understand what you’re buying, and set clear limits. Credit is a tool — not a guarantee you’ll come out ahead.

Know the Risks Before You Dive In

Of course, credit comes with strings. If you win an item and your loan falls through, or the repayments turn out to be too much, you’re in a bad spot. And if the item doesn’t end up being worth what you thought — maybe it needs repairs, or it’s harder to sell — you could be stuck making payments on something that’s not helping you financially.

So before you bid, do your homework. If it’s a car, know its market value. If it’s a machine, know what it’ll cost to fix or install. Auctions often sell items “as-is,” and you may not get a second look before bidding. You have to be ready — and realistic.

Keep Your Payments Manageable

It’s also important to make sure your loan payments won’t stretch you too thin. Just because you can technically afford it doesn’t mean you should take on the full amount. Leave yourself some breathing room. Life throws curveballs, and you don’t want a monthly loan payment to be the thing that breaks your budget.

Online Auctions Make It Easier — and Riskier

As more auctions move online, some platforms even offer financing options built in. You can apply right there on the site while you’re browsing. It sounds convenient, and it is — but it also means people can end up borrowing money with just a few clicks and not fully understanding the terms. Fast approvals don’t always mean friendly terms.

If you’re borrowing through an online auction site, take a few minutes to read the fine print. Look at the interest rate, the fees, the repayment terms — all of it. If it’s unclear or too good to be true, step back. You don’t want to end up stuck in a high-interest deal that drags on for years just because you didn’t pause for a second look.

Use Credit as a Tool, Not a Crutch

When used wisely, credit can help you grow — especially if you’re running a small business. It lets you invest in new gear, stock up on inventory, or take a chance on something that could pay off. But don’t let it become your fallback for every purchase. Not every deal is worth borrowing for, and not every win at an auction is actually a win in the long run.

Set a budget. Know your limits. And don’t let the excitement of the moment push you into a decision that’ll be hard to live with six months down the line. Auctions are exciting, but the smart money goes to people who plan — not just those who bid fast.

The Bottom Line

Financing can make auctions more accessible, more flexible, and more useful — if you know how to use it. It’s not about chasing every deal. It’s about being ready for the right one. Borrow when it makes sense, be smart about your repayments, and don’t forget: you’re in control of the bid, the loan, and the outcome. Credit doesn’t have to be scary. It just has to be handled with a bit of care — and maybe a calculator.